If the Marcos regime refuses to drop its deregulation policy and continues to pretend it’s powerless against the greed-driven oil industry, it’s essentially endorsing the ongoing fleecing of our people at the fuel pumps. Over the past four years, Philippine oil companies have collectively overcharged us by approximately ₱40.09 per liter for diesel and ₱33.21 for gasoline. This is a direct result of a deregulated pricing system that allows these companies to hike prices disproportionately to global market conditions that they’re supposed to merely reflect in their local price adjustments. In some cases, they’ve even raised prices when global prices were indicating they should be lowered.

As of September 12-18, 2023, the average diesel price in Metro Manila is ₱64.75 per liter, and ₱75.70 for diesel plus. Without this unjust overpricing, diesel prices in the capital could plummet to as low as ₱24.66 per liter for regular diesel or ₱35.61 for diesel plus. This isn’t just a number; it’s a lifeline for our jeepney drivers who would see their earnings rise significantly. Moreover, it’s a sigh of relief for daily commuters who won’t have to bear the brunt of fare hikes.

On the gasoline front, the average prices in Metro Manila are ₱65.50 per liter for RON91, ₱71.15 for RON95, and ₱75.15 for RON97/100. Strip away the overpricing, and gasoline could be as affordable as ₱32.29 per liter for RON91, ₱37.94 for RON95, and ₱41.94 for RON97/100. This is a significant amount of money saved for motorists (instead of being pocketed by the profiteering oil firms), especially those who rely on their vehicles for their livelihoods.

Let’s not forget the domino effect: lower oil prices mean lower prices for food and other daily necessities. With families having more money to spend, production can pick up, and our overall economy can become healthier.

There are countless logical, just, and urgent reasons for Congress to repeal the Oil Deregulation Law, also known as Republic Act (RA) 8479. The Marcos administration must prioritize this as a legislative action. There’s no room for half-hearted reforms within the current system. Attempting to tweak deregulation to benefit consumers is futile. Even the modest demand for transparency in oil pricing, like unbundling costs, has been staunchly resisted by the oil industry. They’ve gone so far as to secure a court injunction to prevent unbundling fuel costs. Under RA 8479, the state’s only role is to monitor international and local price movements and ensure compliance with national standards. This essentially hands over our fate to the unaccountable global network of oil monopolies, traders, and financial speculators, allowing them to dictate what a struggling jeepney driver, a fisherman, or a small eatery owner must pay for diesel, gasoline, or LPG. This neoliberal policy environment enables abusive pricing behavior.

Oil is not just another commodity; it’s a strategic public interest due to its profound impact on people’s well-being and the overall state of our economy. Unfortunately, deregulation and neoliberalism have pushed the state to abandon its duty to develop and regulate the oil industry from exploration to retailing. Even the simple act of unbundling prices so the public can see the different components of fuel costs is seen as compromising Petron’s “trade secrets” or threatening Shell’s “competitive advantage”. Last year, Petron reported an official net income of ₱6.2 billion, a 9% increase from 2021, while Shell raked in ₱4.1 billion, a 6% increase. Meanwhile, in 2022, diesel prices shot up by ₱27.30 per liter, gasoline by ₱14.90, and kerosene by ₱21.30. As these soaring oil prices drove overall inflation to record highs, the number of Filipino families categorizing themselves as poor skyrocketed by over half a million between 2021 and 2022, approximately 2.5 million people, according to surveys by the Social Weather Stations (SWS).

The choice is clear: repealing the Oil Deregulation Law is a defining moment for our policymakers. It’s about deciding whether to protect the people and their legitimate interests or continue to support the unjustifiable multi-billion profits of big oil companies.

Notes on the oil overpricing estimates

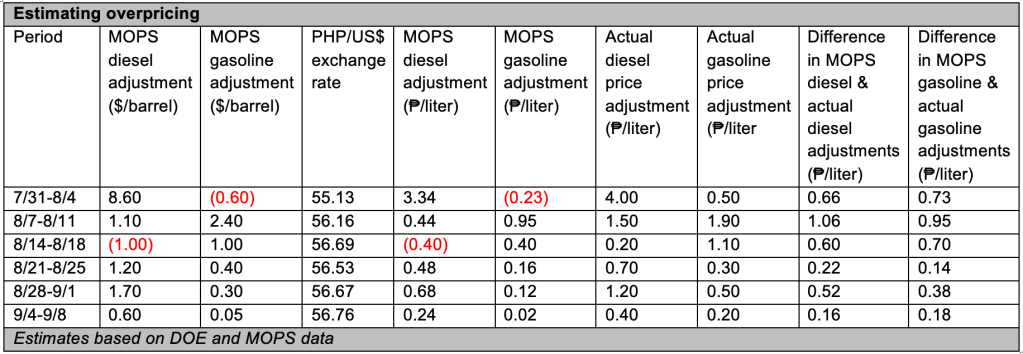

The estimates were derived by computing the adjustments based on the weekly price movements of diesel and gasoline as posted by the Mean of Platts Singapore (MOPS) – the regional pricing benchmark for refined petroleum products used by the Philippines’ Department of Energy (DOE). S&P Global Platts, a private energy and commodities information provider, publishes MOPS prices. Quoted in US dollars per barrel, MOPS diesel and gasoline prices are converted into Philippine pesos per liter based on weekly foreign exchange (FOREX) rates. MOPS prices and FOREX rates used are those published by the DOE in their weekly Oil Monitor reports. The results are then compared to the actual price adjustments announced by the oil companies and recorded by the DOE to estimate the overpricing. An example covering the last six MOPS trading weeks is shown below:

To illustrate using the table above, during the Jul 31 to Aug 4 trading days, the price of MOPS diesel increased by ₱3.34 per liter, but the price adjustment announced by the oil firms on Aug 8 was ₱4 per liter or an overpricing of ₱0.66 per liter. During the same period, MOPS gasoline went down by ₱0.23 per liter, but the oil companies increased the local pump price by ₱0.50 per liter or an overpricing of ₱0.73 per liter. This small sampling shows two instances when oil companies hiked prices even when MOPS prices declined. Aside from the Aug 8 case of gasoline prices, MOPS diesel also fell by ₱0.40 per liter during the Aug 14-18 trading days, but oil firms implemented a diesel price hike of ₱0.20 per liter on Aug 22 or an overpricing of ₱0.60 per liter. In the week of Sep 4-8, MOPS gasoline practically did not move, but oil firms still hiked local gasoline pump prices by ₱0.20 per liter on Sep 12.

In the last six weeks alone, oil companies have overpriced their diesel by ₱3.22 per liter and gasoline by ₱3.08.

Using this same process from January 2020 up to the Sep 12, 2023 price adjustments, the cumulative overpricing for diesel is ₱40.09 per liter, and gasoline is ₱33.21 per liter.

These overpricing estimates only consider the price adjustments based on the MOPS benchmark prices and FOREX rates. They do not include a comparison of actual costs of production or exploration, refining, transportation, storage, etc., versus prevailing or common retail prices, which could yield much higher overpricing given the concentration of monopoly control over the global oil industry. Nonetheless, overpricing estimates based on MOPS adjustments provide a helpful glimpse into the pricing abuses that oil firms commit under a deregulated oil industry where they can adjust prices weekly without government intervention. It dismantles the narrative that oil companies simply reflect global oil price movements. ###

What do you think?